How It Works

How trade receivable Put Options work

Discover the power of non-cancelable Put Options from TradeGuard

How do Put Options from TradeGuard work? Watch our video.

You’re thinking about servicing a customer.

But you’re concerned about the prospect of the customer filing for bankruptcy.

You could spend time trying to asses the customer’s credit risks.

But that’s not what you do best.

You could simply choose to not do business with the customer.

But that’s no way to grow your business.

You could simply ship to the customer and hope for the best. But who needs that kind of stress?

So, you make the smart move. You contact TradeGuard.

We’ll present a customized quote for a Put Option to you in minutes.

Our fees are always competitive. And our onboarding process (finalization of coverage) is quick and painless.

If your customer doesn’t file for bankruptcy, you won’t need us.

But if your customer does file for bankruptcy, we’ll pay your outstanding invoices. Guaranteed.

Get Protected Now

Click or call to get your TradeGuard Put Option quote started.

Put Options from TradeGuard provide a tailored form of protection

- A Put Option applies to a particular account of a vendor, not its entire receivable portfolio.

- The duration of a Put Option is also flexible; a Put Option can be structured to cover a period as short as 3 months or as long as 5 years.

- Unlike trade insurance and factoring agreements, a Put Option cannot be canceled or modified by TradeGuard to drop or limit coverage.

- The confidentiality of a Put Option allows a vendor to continue to supply and thereby, support its customers without increasing its risk exposure.

- There are no surprises or hidden fees. Just the tailored protection you need—and the peace of mind that comes with it.

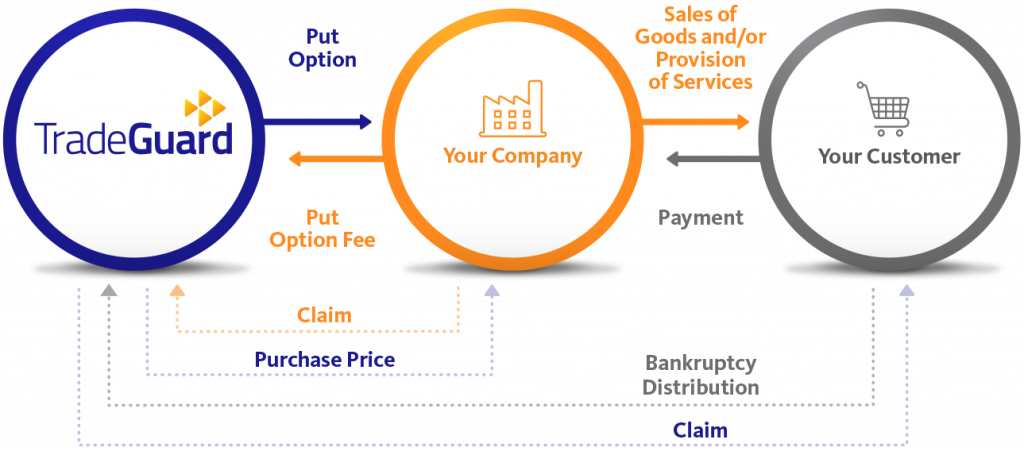

TradeGuard Vendor Protection Process

There are basically two types of Put Options: Pre-Bankruptcy Put Options and Post-Bankruptcy Put Options

- A Pre-Bankruptcy Put Option is a right to sell a claim against a company that could file for bankruptcy protection.

- A Post-Bankruptcy Put Option is a right to sell a claim against a company that is operating under bankruptcy protection and that could wind down and liquidate.

Below is a description of the salient terms of TradeGuard’s Put Options:

- Claim Purchase Rate: The rate at which TradeGuard will purchase the claim upon the occurrence of a Credit Event (100% or less, depending on the credit).

- Covered Period: The period of time during which a Put Option covers a vendor’s sale of goods and provisions of services. The Covered Period can be as short as 3 months to as long as 5 years.

- Credit Event: In the case of a Pre-Bankruptcy Put Option, a bankruptcy filing of the company. In the case of a Post-Bankruptcy Put Option, a conversion from chapter 11 to a chapter 7, or a confirmed chapter 11 plan that does not pay administrative creditors in full.

- Put Option Fee: Typically, a monthly fee between 0.15% and 3.50% of the accounts receivable covered to be paid by a vendor to TradeGuard. The Put Option Fee is payable upon execution if Covered Period is less than 6 months or payable quarterly in advance if Covered Period is greater than 6 months.